Criminals occasionally prey on SDIRA holders; encouraging them to open accounts for the objective of earning fraudulent investments. They frequently fool traders by telling them that When the investment is approved by a self-directed IRA custodian, it needs to be reputable, which isn’t real. Yet again, make sure to do thorough homework on all investments you end up picking.

Simplicity of use and Technologies: A user-friendly System with on line applications to trace your investments, submit documents, and manage your account is essential.

Opening an SDIRA can give you usage of investments Typically unavailable via a financial institution or brokerage firm. Here’s how to start:

When you finally’ve uncovered an SDIRA service provider and opened your account, you may well be thinking how to really start out investing. Being familiar with both of those The foundations that govern SDIRAs, together with tips on how to fund your account, can assist to lay the muse for your future of effective investing.

However there are lots of Added benefits linked to an SDIRA, it’s not with no its have drawbacks. A number of the prevalent main reasons why buyers don’t select SDIRAs contain:

Real estate is one of the most well-liked selections among SDIRA holders. That’s since you could spend money on any sort of real estate using a self-directed IRA.

Be in charge of how you grow your retirement portfolio by using your specialised awareness and pursuits to take a position in assets that in shape with the values. Obtained abilities in real-estate or personal equity? Utilize it to guidance your retirement planning.

The tax strengths are what make SDIRAs beautiful For most. An SDIRA might be the two conventional or Roth - the account type you end up picking will rely largely on your own investment and tax approach. Verify with your economical advisor or tax advisor in case you’re unsure which happens to be ideal for you personally.

And since some SDIRAs for example self-directed traditional IRAs are subject to necessary least distributions (RMDs), you’ll really need to strategy ahead making sure that you have got enough liquidity to meet the rules established by the IRS.

In advance of opening an SDIRA, it’s vital that you weigh the potential advantages and drawbacks according to your precise monetary goals and chance tolerance.

Better investment solutions implies you may diversify your portfolio beyond stocks, bonds, and mutual funds and hedge your portfolio against marketplace fluctuations and volatility.

Buyer Aid: Hunt for a provider that offers devoted aid, which includes access to educated specialists who will respond to questions about compliance and IRS procedures.

Lots of buyers are surprised to here are the findings find out that making use of retirement money to take a position in alternative assets has been attainable considering the fact that 1974. Having said that, most brokerage firms and banks concentrate on supplying publicly traded securities, like stocks and bonds, as they lack the infrastructure and experience to manage privately held assets, such as real-estate or personal equity.

Introducing money on to your account. Take into account that contributions are topic to yearly IRA contribution boundaries established via the IRS.

In the event you’re trying to find a ‘set and overlook’ investing approach, an SDIRA in all probability isn’t the appropriate alternative. Simply because you are in overall Management in excess of every single investment created, It is really your decision to carry out your own homework. Don't forget, SDIRA custodians usually are not fiduciaries and can't make recommendations about investments.

No, You can not invest in your individual business by using a self-directed IRA. The IRS prohibits any transactions concerning your IRA as well as your possess business enterprise because you, as being the operator, are thought of a disqualified person.

Higher Costs: SDIRAs generally have bigger administrative expenses when compared to other IRAs, as sure components of the executive course of action can't be automated.

A self-directed IRA is surely an exceptionally potent investment car or truck, nevertheless it’s not for everybody. As the expressing goes: with great electricity will come great duty; and by having an SDIRA, that couldn’t be more accurate. Keep reading to know why an SDIRA might, or might not, be for you personally.

Complexity and Responsibility: By having an SDIRA, you've additional Handle more than your investments, but You furthermore mght bear extra responsibility.

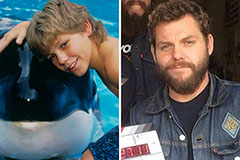

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!